Finance and credit can be scary for parents. Whether preparing for childcare costs, accessing benefits or helping your teenager learn to drive, there's so much to be considered. And so much to pay for. But there is support and guidance, whatever your circumstances. Here, we explore the ins-and-outs of managing finance as a parent. Expect easy-to-read, helpful advice with no strings attached.

Pregnancy

The antenatal phase is a stressful one. Add in the financial element and it can feel overbearing. But there's no need to worry - help is available. Here, we'll look at your rights to parental leave and how you can plan for your baby's arrival.

Top Tip

Don't use annual leave for antenatal care if you are entitled to maternity leave. UK law states your employer must cover this too.

The Ultimate Guide to Shared Parental Leave

Share up to 50 weeks of leave and 37 weeks of pay so no parent's career or bonding is affected.

Read More

How To Budget on Maternity & Paternity Leave

70% of employed men are eligible for paid paternity leave.

Read MoreBabies

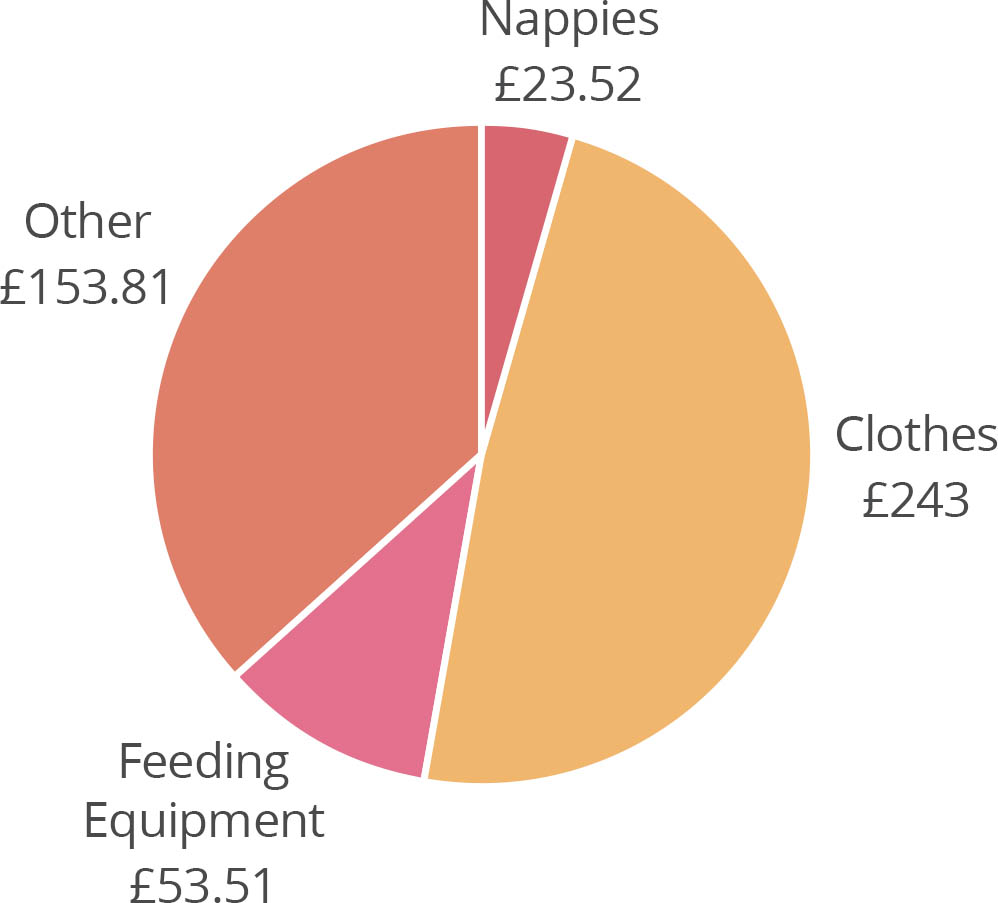

The average cost of having a baby for the first month alone is over £500

Managing Finances When Your Little One Arrives Home

Settling in to life as a parent can be stressful. Here we try to reduce that stress with guidance on finances for new parents.

Read MoreA Guide to Childcare for New-Borns to 3 Year Olds

64% of parents said they weren't prepared for the costs of a new baby.

Read More

Children

Did You Know?

Only 36% of parents encourage their children with advice on how to spend and save their pocket money most practically.

Teaching Your Kids How To Manage Money

"In a study by T.Rowe Price, 49% of young adults said they wished their parents spoke to them more about finance and credit when they were children."

Read More

Top 5 Money-Saving School Lunchbox Ideas

- Ham & Cheese Quesadillas

- Tuna & Bean Salad

- Mini Pizza Dippers

Teenagers

Did You Know?

80% of students say they are not taught enough about personal finance in school.

How to Help Your Teenager Build Their Credit Rating

- Teach them about credit

- Phone contracts for under-18s

- Add them to your credit card

The Real Cost of Teaching Your Kid to Drive

"The average learner takes 45 lessons to pass their test. This typically clocks in at around £1,134."

Read More

Parents

Did You Know?

Between 2013 and 2019, the cost of bringing up a child rose by 5.5% for couples and 19.5% for single parents.

Dealing with Your Finances as a Single Parent

Bringing up a child as a single parent can be difficult. Here, we take a look at how you can manage without the support of a partner.

Read More

Financial Support & Benefits for Parents

- Tax credits for parents

- Child benefits for kids aged 16+

- Guardian's allowances

References

- Citizens Advice Bureau - Rights While You're Pregnant at Work

- UK Women's Budget Group on Maternity, Paternity and Parental Leave

- CPAP: The Cost of a Child in 2019